If you’ve been negatively impacted financially by the government lockdowns during the Coronavirus pandemic, you’re not alone. Millions of people are still out of work, hundreds of thousands of businesses have closed down, and many Americans still face the prospect of eviction or foreclosure.

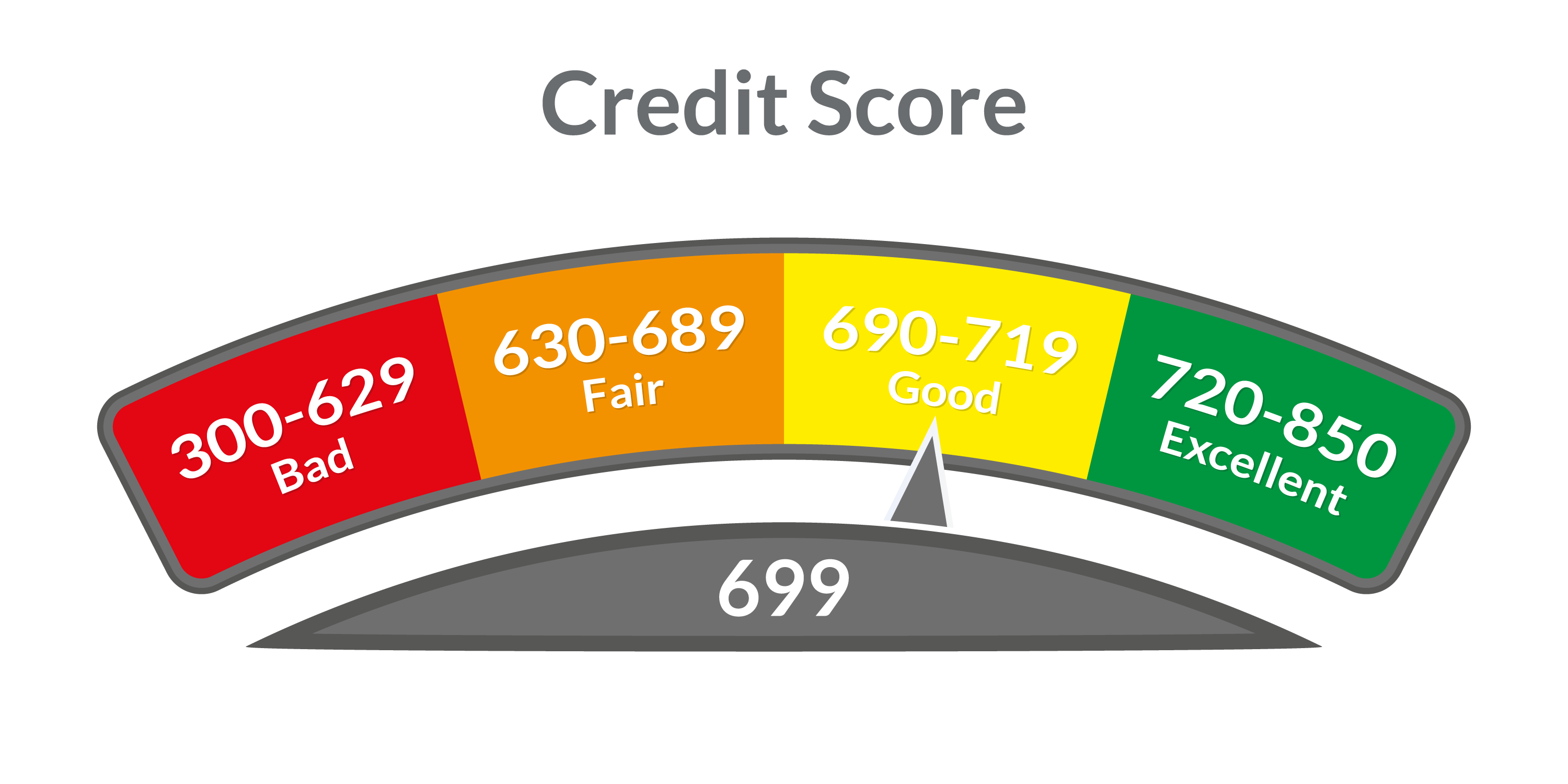

Surprisingly, average credit scores actually increased during the pandemic. Of course, this may not be true for everyone that experienced financial difficulties in the past year, but it should give you hope that you aren’t as far away from a better credit score as you might think. If you weren’t one of the fortunate Americans who experienced an increase in their credit score, here are some tips that could get you back on track sooner than later.

If you need help improving your credit score, consider reaching out to one of our trained credit counselors right away. The Credit Score Improvement Helpline at (888) 537-4633 will connect you with a credit expert to discuss your options for raising your credit score. While on the phone with you, they will pull your report and discuss ways to remove negative entries that may be weighing it down. They will also give you advice about which debts to concentrate your efforts, in order to raise your score.

Communicate with your lender(s)

Provisions of the C.A.R.E.S Act have given many lenders the latitude to modify their lending agreements. These modifications could include forbearance, deferred payment arrangements, or other concessions to help delinquent borrowers.

Many people think that this relief is extended to them automatically, but that’s rarely the case. More often than not, people will have to connect with their lenders, apprise them of their economic hardship, and then work out alternative payment arrangements. But the work doesn’t stop when you make a deal with the bank.

If you successfully negotiate alternate payment arrangements such as a loan modification, it’s essential to understand how your credit report could be affected. Some lenders, like credit card companies, may not report any information to the credit reporting bureaus, while others will. Any missed payments reported due to COVID-19 arrangements should not reduce your credit score, but it could still be reflected on your credit report.

Finally, you’ll want to make sure that any arrangement you make with your lenders is secured in writing. Unfortunately, recent times have given rise to many scams and fraudsters who are taking advantage of vulnerable borrowers. If you are getting unsolicited calls to settle your debt or send payments to an unaffiliated party, beware of doing anything without a written agreement.

Ensure that you communicate with your lenders through official channels like a customer service number that you call directly or a website portal that authenticates your identity. From here, you should be able to request or see copies of your payment arrangements. A written record will keep both you and your lender accountable to any new agreements.

Use your stimulus money wisely

If, at any point, you take advantage of flexible payment options on your debt, now would be an excellent time to consider using your government stimulus money to reduce any loan balances, especially high-interest ones.

A portion of your credit score is calculated based on how much of your available credit you are actually using. For example, if you have access to $15,000 across all of your credit lines, your balance across those lines will factor into your credit score.

For instance, if you are using $14,000 of that $15,000 of available credit, your score would likely be lower than if you were using only $2,000 of your available credit. If you are looking for ways to improve your credit score, paying down your balances is a great way to reach this goal.

Even if you haven’t yet received your stimulus money or are not eligible for stimulus payments, you can still use other extra monies to reach this goal. If you expect an income tax refund or some other windfall, paying off debt would be a good use of this money.

If you don’t expect much in the way of extra money, you could also go about “creating” extra money to pay down debt. You can sell things around the house or start a side hustle to generate additional income to reduce your debt balances.

Have a post-pandemic plan

While the U.S. economy is undoubtedly returning to pre-pandemic levels, many Americans are finding work and beginning the financial recovery process. Lenders and credit issuers will be ending their COVID relief options and conducting business as usual. This should be your cue to work on a personal financial plan that will work when the COVID relief options wind down.

This plan might include scaling back your spending to save or pay down debt, looking for part-time work, or checking out ways to refinance your debt into lower-interest loans. Some options could include refinancing your home, considering a 401k loan, or moving high-interest credit card balances to lower interest credit card accounts.

If you are still experiencing financial hardship, this post-pandemic financial plan might be a little more challenging to work out, but it’s worth a try. Even if all of the solutions aren’t immediately apparent, you’d be surprised at how just a short brainstorming session might produce ideas to help you get back on track financially.

Consider bankruptcy

Although this probably isn’t the first choice for most people, it could be a financial lifeline in dire circumstances. If you are experiencing extreme economic hardship preventing you from meeting your financial obligations, you might be a good candidate for filing bankruptcy.

Here some benefits to filing for bankruptcy:

- Put a stop to debt-collection activities

- Most unsecured debts are discharged (deleted)

- You may still be able to keep some property and possessions

- Your credit score is likely to improve with time

- A fresh start may help you develop wiser financial habits

With bankruptcy, your credit score can take a significant hit. It will take time for your credit to recover, but it could provide the new fresh financial start you need to go forward and ultimately rebuild your credit score. Being chronically late on payments for years is worse than wiping all debt clean, and starting over by making consistent timely payments.

Get help

If you are facing economic hardship along with a decreasing credit score, you should know that you don’t have to deal with this problem alone. There are many resources available to help you get started on the path to financial and credit score improvement.

To speak with a caring credit counselor, call the Credit Score Improvement Helpline at (888) 537-4633. You’ll be connected with a trained credit expert to discuss your options. These options might help you improve not only your financial standing but also your credit score.

Aja McClanahan is a blogger, freelance writer, and book author who covers personal finance and small business topics. She resides in Chicago with her two children and husband.